TRX, the native token of the TRON blockchain, has jumped 12% over the past day, making it the top gainer in the crypto market.

The price of TRON (TRX) soared 10.6% on Aug. 21, exchanging hands at $0.1594, a high not seen since April 16, 2021. The token’s daily trading volume had also jumped by 121%, hovering around $1.92 trillion, per data from crypto.news.

Moreover, TRX’s market capitalization has also jumped, standing at $13.89 billion, marking it as the 11th largest cryptocurrency per CoinGecko.

The surge appears to be fueled by the launch of SunPump, TRON’s attempt at cashing in on the memecoin hype. According to Dune Analytics, since its launch, over 18,000 memecoins created on SunPump have raked 7,080,777 TRX (roughly $1.12 million) in total revenue as of the time of writing.

Meanwhile, TRON’s founder, Justin Sun, has been actively building anticipation with the community. In an X post on Aug. 19, Sun revealed that “several major meme community leaders” have shown interest in moving to TRON, without naming them.

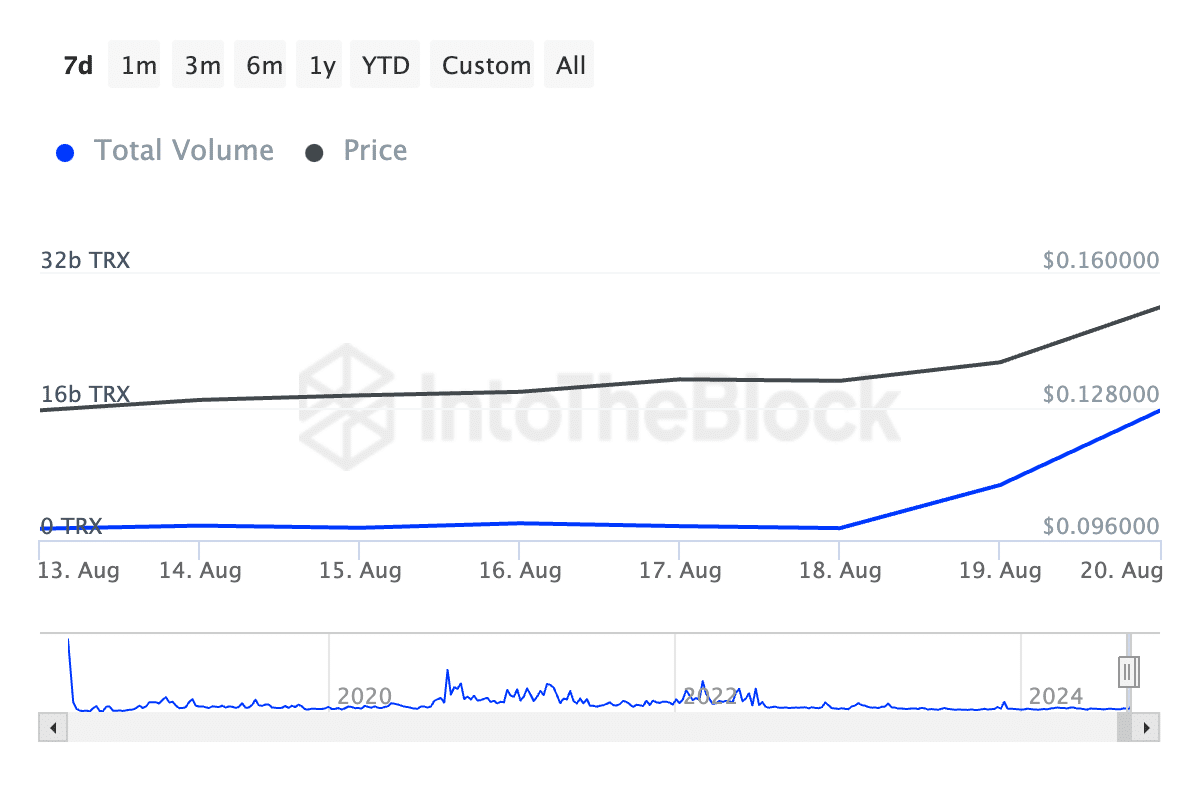

Should these communities transition to TRON, the network could potentially experience a rise in transaction volume, which has surged over 1045% since the beta launch of SunPump on Aug. 13. The total number of daily active addresses has also jumped over 10%, per data from IntoTheBlock.

As TRON’s transaction volume surges, overbought signals loom

Among other positive developments, the TRON blockchain processed transaction settlements amounting to $1.25 trillion in Q2, 2024, as reported by Token Terminal, accounting for one-third of the total settlement volume recorded by Visa during the same period, adding to the optimistic sentiment.

Further, 30-day revenue statistics are also highly positive for TRON, which surpassed Ethereum’s protocol revenue by 230%. These developments have pushed the price of TRX towards its 2021 all-time high, with the token down just 31.3% short of reaching that level.

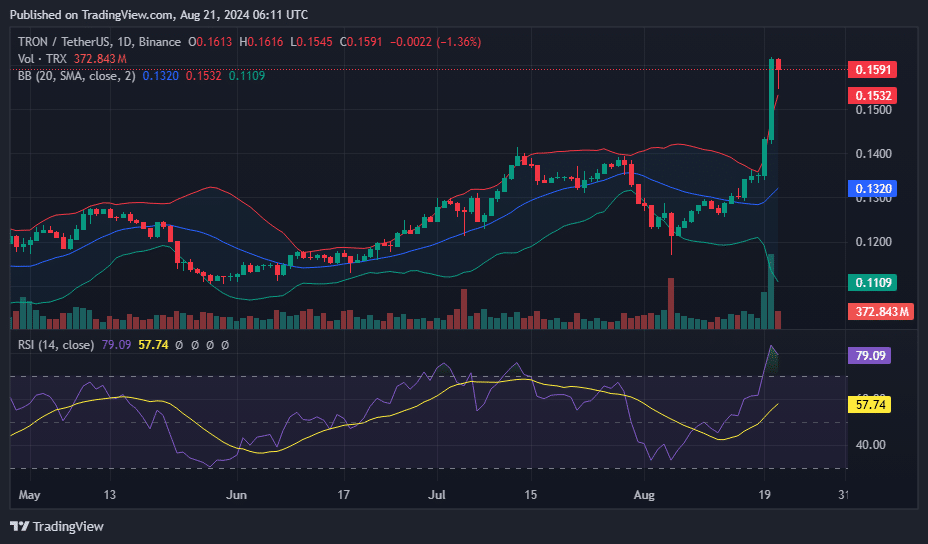

TRX’s current price is slightly above the upper Bollinger Band at $0.1532, indicating it’s trading outside its typical range and may be overbought. The recent surge has pushed TRX beyond the upper band, suggesting potential resistance or a pullback.

TRON’s Relative Strength Index is at 79.09, above the 70 threshold, confirming strong upward momentum but also signaling a possible market reversal or consolidation. The overall trading volume for TRX has also increased alongside the price, indicating strong buyer interest. Still, with the RSI in overbought territory and the price exceeding the Bollinger Band, caution is advised as a correction or consolidation may occur before the next move.

Given these technical factors, the market may be preparing to either solidify its gains with some sideways movement or face a pullback, making it critical to monitor for signs of weakening momentum or increased selling pressure.