Bitcoin, the leading cryptocurrency by market cap, has pulled back from its six-week high, dipping below the $67,000 mark on Tuesday morning.

The drop in Bitcoin (BTC) comes after news on Monday, July 29, that the United States government moved $2 billion worth of seized Bitcoin, raising investor concerns about the potential sale of these assets. This movement came just two days after presidential hopeful Donald Trump announced his intention to start accumulating BTC, which pushed up to the $70,000 mark yesterday for the first time since mid-May.

Data from Arkham Intelligence indicates that the government moved 29.8k BTC worth $2.02 billion out of its total holdings of 183,439 BTC to an unknown address, generating a fresh wave of fear in the markets.

As news spread, tweets suggesting the U.S. government’s intention to sell these Bitcoins caused panic, leading Bitcoin’s price to drop to $66,500.

At the time of writing, Bitcoin was trading around $66,800, down about 4% over the last 24 hours. Bitcoin’s 24-hour low was $65,997, while its high was $69,932, according to data from crypto.news.

Directly following Trump’s speech on Saturday, Wyoming Senator Cynthia Lummis presented new legislation for the U.S national Bitcoin reserve, which includes a proposal that the U.S. Treasury should acquire an additional one million BTC.

Bitcoin SV surges amid legal victory

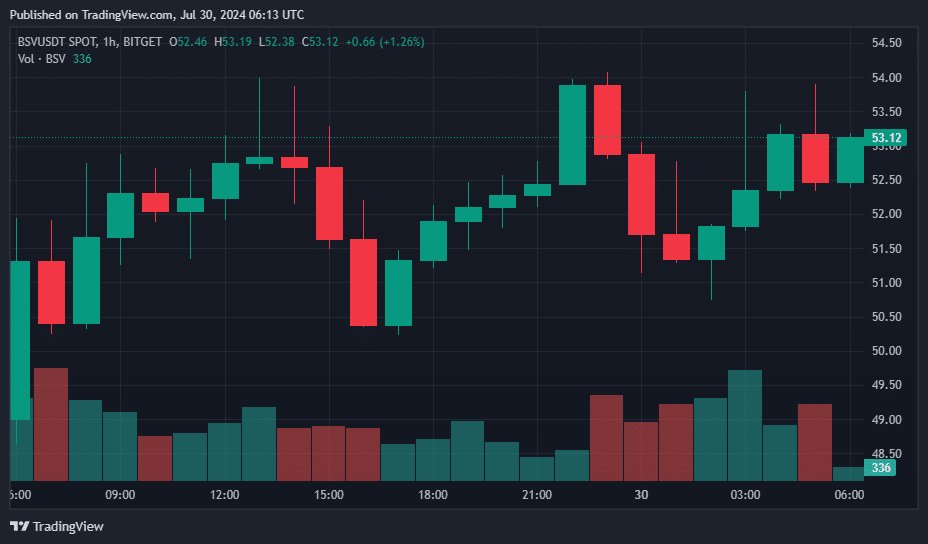

Meanwhile, amid the drop in Bitcoin, Bitcoin SV (BSV) had surged 9% in the last 24 hours, making it the leading gainer among the top 100 cryptocurrencies by market cap on Tuesday morning.

The surge follows renewed optimism amongst BSV holders following last week’s news that the United Kingdom’s Competition Appeals Tribunal approved a £10 billion lawsuit initiated by BSV Claims Limited against four crypto exchanges that delisted the token in 2019.

The case was initially filed in August 2022, representing 240,000 UK investors in the controversial Bitcoin Cash hardfork. The lawsuit claims that crypto exchanges Binance, Bittylicious, Kraken and Shapeshift engaged in anti-competitive behaviour by delisting the cryptocurrency.

Bitcoin SV was delisted on multiple major global exchanges following years of controversy and claims from Craig Wright that he was Satoshi Nakamoto, the anonymous creator of Bitcoin. Wright has been a vocal advocate for BSV and has even claimed that is is the real Bitcoin.

However, a recent court ruling stated that Wright “lied to the Court” and “forged documents” relevant to the case to back his claims.

BSV has also been delisted from exchange giants like Coinbase, which halted trading of the asset earlier this year. Other exchanges, like Robinhood, have also taken similar measures.

At the time of writing, BSV was exchanging hands at $56.96. The crypto asset’s daily trading volume hovered over $100 million, per data from crypto.news.

Moreover, the cryptocurrency’s market cap stood at over $1.2 billion, making it the 77th largest crypto asset. Despite the recent price rise, the token is still down 89% from its all-time high of $490, reached on April 16, 2021.

Meanwhile, other popular altcoins, including Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP) and Solana (SOL), experienced significant drops ranging between 1 to 5% over the last 24 hours. The overall crypto Market Fear & Greed Index stood at 67 (Greed) out of 100, according to data from Alternative.

At the time of writing, the global crypto market cap of all cryptocurrencies stands at $2.51 trillion, reflecting a 24-hour drop of 3.2%.