The Report (1:15)

Ryan Luby: The McKinsey Global Institute and McKinsey’s real estate practice is excited to launch our latest flagship report, Empty spaces and hybrid places: The pandemic’s lasting impact on real estate. We explore the impact of hybrid work across office, residential and retail real estate. We explicitly take a global lens here focusing on a set of superstar cities. My name’s Ryan Luby. I’m an associate partner with McKinsey and Company. I sit within the McKinsey Global Institute. I’m an economist and think about this disruption quantitatively in terms of the economic value at stake and both from a risk downside perspective, but also an opportunity and an upside that’s potentially unlocked within both labor markets and real estate markets as a result of evolving trends around hybrid work.

Ryan Luby: The McKinsey Global Institute and McKinsey’s real estate practice is excited to launch our latest flagship report, Empty spaces and hybrid places: The pandemic’s lasting impact on real estate. We explore the impact of hybrid work across office, residential and retail real estate. We explicitly take a global lens here focusing on a set of superstar cities. My name’s Ryan Luby. I’m an associate partner with McKinsey and Company. I sit within the McKinsey Global Institute. I’m an economist and think about this disruption quantitatively in terms of the economic value at stake and both from a risk downside perspective, but also an opportunity and an upside that’s potentially unlocked within both labor markets and real estate markets as a result of evolving trends around hybrid work.

Phil Kirschner: My name is Phil Kirchner. I’m a senior expert at McKinsey in our New York office, focused very much on not third places, but activated and experiential workplaces. When Covid happened with much of my client service being on the occupier side, there are many who were never really studying the workplace before.

The Context (02:31)

Ryan Luby: We wrote this report for a wide variety of audiences, not only on the real estate industry, but also any occupier of real estate or public sector agencies that are providing framing context and really everyone in between. I think part of what’s special about real estate as a portion of the economy is that everyone touches it on a daily basis, whether you’re living, working or playing. So we see it as broad and general interest. The set of topics that we really wanted to focus on; we really honed in on the impact of hybridity and remote work focused initially on the shock driven by shifting office attendance patterns. We explicitly took a global perspective here and we really spent a lot of time thinking about variation in outcome across those pieces. Ultimately, we had to balance this international cross-sectional view with the reality that real estate itself is quite a local industry and we had to dig in often in many cases to neighborhood specific dynamics to look at the vulnerabilities that were really driven by local level dynamics, the extent of mixed use within a particular neighborhood, and that linked to office attendance, commuter patterns and the like.

Ryan Luby: We wrote this report for a wide variety of audiences, not only on the real estate industry, but also any occupier of real estate or public sector agencies that are providing framing context and really everyone in between. I think part of what’s special about real estate as a portion of the economy is that everyone touches it on a daily basis, whether you’re living, working or playing. So we see it as broad and general interest. The set of topics that we really wanted to focus on; we really honed in on the impact of hybridity and remote work focused initially on the shock driven by shifting office attendance patterns. We explicitly took a global perspective here and we really spent a lot of time thinking about variation in outcome across those pieces. Ultimately, we had to balance this international cross-sectional view with the reality that real estate itself is quite a local industry and we had to dig in often in many cases to neighborhood specific dynamics to look at the vulnerabilities that were really driven by local level dynamics, the extent of mixed use within a particular neighborhood, and that linked to office attendance, commuter patterns and the like.

I think the final piece that we really wanted to spend time thinking about was the real opportunity that this moment of disruption creates, and from that perspective, it’s actually quite important to have an inclusive audience in mind and a report that speaks to each of the components and how they can work together moving forward.

The Differentiator (04:18)

Phil Kirschner: There are a number of questions that we hear most commonly from leaders, and on one end they’re the ones we hear about in the press like ‘how many days should we be back? What is everybody else doing? Or which version of hybrid is the best version?’ An employee’s experience is so influenced by many, many things. They have nothing to do with the built environment, but on the other end you have some executives who come to us with a very different question, like ‘the world has changed. Now, how do we need to reimagine our employee experience, our customer experience, having learned everything?’ We know now about all the massive changes in how work gets done, specifically because of Covid, but because of the things that were true before and those who come in with a child’s mind about it and are willing to test and learn with new experiences and new technologies and new approaches to real estate are the clients of ours that have led to the most transformative change. So ones who have taken 40, 50, 60 or more percent of their office portfolio out while their employee engagement or experience or organizational health continues to go up and I think the major differentiator for them is not just saying ‘this is the way’, but instead ‘what can we be doing to make tomorrow incrementally better than today was’ and acknowledging where we tried something that didn’t work; that amount of fallibility. We have clients across industries, but that for me is the major differentiator. The ones who say, ‘look, I want to learn and treat my employees like we do our customers’ because they’re basically making retail-oriented choices about work and our retail preferences change.

Phil Kirschner: There are a number of questions that we hear most commonly from leaders, and on one end they’re the ones we hear about in the press like ‘how many days should we be back? What is everybody else doing? Or which version of hybrid is the best version?’ An employee’s experience is so influenced by many, many things. They have nothing to do with the built environment, but on the other end you have some executives who come to us with a very different question, like ‘the world has changed. Now, how do we need to reimagine our employee experience, our customer experience, having learned everything?’ We know now about all the massive changes in how work gets done, specifically because of Covid, but because of the things that were true before and those who come in with a child’s mind about it and are willing to test and learn with new experiences and new technologies and new approaches to real estate are the clients of ours that have led to the most transformative change. So ones who have taken 40, 50, 60 or more percent of their office portfolio out while their employee engagement or experience or organizational health continues to go up and I think the major differentiator for them is not just saying ‘this is the way’, but instead ‘what can we be doing to make tomorrow incrementally better than today was’ and acknowledging where we tried something that didn’t work; that amount of fallibility. We have clients across industries, but that for me is the major differentiator. The ones who say, ‘look, I want to learn and treat my employees like we do our customers’ because they’re basically making retail-oriented choices about work and our retail preferences change.

Hybrid Questions (06:10)

Ryan Luby: One set of questions really focuses on the link between hybridity of work and labor markets and to what extent do we see do we expect the bargaining space between employers and employees to evolve moving forward? That’s closely related to a second set of questions where we think about this link between hybridity of work and then productivity at different levels of the organization, and there’s this interesting question around whether hybrid work is a new technology, a new operating model could actually drive productivity gains. The answer almost certainly lies somewhere in between where you have variation in impact across sectors, occupation geographies and firms.

Ryan Luby: One set of questions really focuses on the link between hybridity of work and labor markets and to what extent do we see do we expect the bargaining space between employers and employees to evolve moving forward? That’s closely related to a second set of questions where we think about this link between hybridity of work and then productivity at different levels of the organization, and there’s this interesting question around whether hybrid work is a new technology, a new operating model could actually drive productivity gains. The answer almost certainly lies somewhere in between where you have variation in impact across sectors, occupation geographies and firms.

Economic Impact of Hybrid (06:58)

Ryan Luby: The other set of really interesting and compelling questions that we get is what does this mean for urban structures in the future of the cities? I think some of the most interesting results from our work over the last year have really looked at differences in impact of hybridity of work across, not only office demand, but retail and residential demand and the impact really on urban ecosystems. I think we’re at this interesting moment and potential inflection point of reinventing urban cores outlying suburbs. I think when we think about this sort of aspirational inspirational questions, motivating context moving forward, it really focuses on that sort of potential vibrancy.

Ryan Luby: The other set of really interesting and compelling questions that we get is what does this mean for urban structures in the future of the cities? I think some of the most interesting results from our work over the last year have really looked at differences in impact of hybridity of work across, not only office demand, but retail and residential demand and the impact really on urban ecosystems. I think we’re at this interesting moment and potential inflection point of reinventing urban cores outlying suburbs. I think when we think about this sort of aspirational inspirational questions, motivating context moving forward, it really focuses on that sort of potential vibrancy.

Multiple Perspectives – Same Conclusion (07:43)

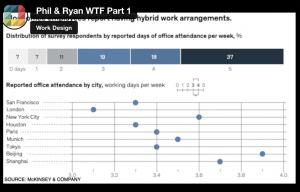

Phil Kirschner: I would just say the office isn’t a requirement anymore, which we’ve sort of known and we knew those of us kind of steeped in workplace research, right? Following surveys over years knew that the office was never five days a week full before, which may have come as a surprise and that was a fun part of the early research. I think actually really with Ryan and the team hashing out what the baseline was and you see in the findings, especially at the city level there more pay attention to sort of what was the trajectory before and what is it now both in the office kind, retail, residential, but baked into all the modeling is like there was vacancy before there was oversupply before we just sort of lived with a certain level of it and where have we crossed the line where it’s no longer acceptable, we can’t ignore the significant level of oversupply.

Phil Kirschner: I would just say the office isn’t a requirement anymore, which we’ve sort of known and we knew those of us kind of steeped in workplace research, right? Following surveys over years knew that the office was never five days a week full before, which may have come as a surprise and that was a fun part of the early research. I think actually really with Ryan and the team hashing out what the baseline was and you see in the findings, especially at the city level there more pay attention to sort of what was the trajectory before and what is it now both in the office kind, retail, residential, but baked into all the modeling is like there was vacancy before there was oversupply before we just sort of lived with a certain level of it and where have we crossed the line where it’s no longer acceptable, we can’t ignore the significant level of oversupply.

We knew those things about the office before and have been even in our own reports slowly leading up to this point of hybrid is here to stay like this is the new normal. A year ago, Ryan in the McKinsey Global Institute also published a major study called the American Opportunity Survey. As the name implies, it was focused in the United States, but that was where we first started having our largest findings on not just how many people in the American working public, not just office jobs, but all job typologies had the ability to work remotely at least a little and how many of them being almost all would take flexibility if offered it. But then a couple of months later you see sort of great attrition, great attraction research from us where employees are expressing just how seriously flexibility is on the list for whether they stay in a job or take a new job.

Then a few months later, another report called State of Organizations out of our people practice focusing not just on days in the week desire, but managers acknowledging the remote is here to stay and that they’re still very new at managing distributed teams this way. And so this final report really surveying again at a global level on intended ideal state days in the office combined with all of the other population movements and retail patterns. It seems like such a simple thing to say, no, the offices aren’t going to be full anymore. Hybrid is here to stay, but even with our most sophisticated clients, it’s taken a layer of different ways of looking at the problem to come to the same conclusion in a way that feels now more final.

Is The Office Out Of Date?(10:20)

Phil Kirschner: Most offices didn’t work for most people most of the time before, and most people wanted more flexibility than they had before. They just didn’t have a choice and now we do, so we’re voting with our feet and as I find myself saying a lot,

Phil Kirschner: Most offices didn’t work for most people most of the time before, and most people wanted more flexibility than they had before. They just didn’t have a choice and now we do, so we’re voting with our feet and as I find myself saying a lot,

we don’t go to bad restaurants twice

The Differentiator (10:39)

Phil Kirschner: Exceptional offices, exceptional workplace experiences and companies that are leaning into much more fluid ecosystems of spaces are by and large getting higher occupancy. Whatever’s considered coworking or flex space within a larger building, the show up rates in those more community and hospitality oriented higher experience density spaces tends to be higher than the traditional or normal older office that may be upstairs.

Phil Kirschner: Exceptional offices, exceptional workplace experiences and companies that are leaning into much more fluid ecosystems of spaces are by and large getting higher occupancy. Whatever’s considered coworking or flex space within a larger building, the show up rates in those more community and hospitality oriented higher experience density spaces tends to be higher than the traditional or normal older office that may be upstairs.

Workplaces Are Not Dead (11:10)

Phil Kirschner: We are so human, we like to connect and be together, but there’s a great deal of work that needs to be done to bring the very factory oriented offices up to speed. Not just in how they’re designed but how they’re activated and even into other topics like how they’re physically run to help us achieve the sustainability targets that we need. There’s a lot of opportunity for improvement even where there is oversupply.

Phil Kirschner: We are so human, we like to connect and be together, but there’s a great deal of work that needs to be done to bring the very factory oriented offices up to speed. Not just in how they’re designed but how they’re activated and even into other topics like how they’re physically run to help us achieve the sustainability targets that we need. There’s a lot of opportunity for improvement even where there is oversupply.

Sector & Structure (11:45)

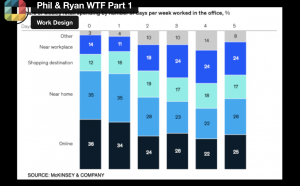

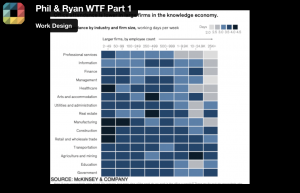

Ryan Luby: Some of the most interesting findings in the report I think centered on the variation in post pandemic attendance that we’re observing and we saw sort of two different drivers of this variation in attendance. You had bread and butter macroeconomic dynamics, which we think about broadly as combination of sector and then firm size. So the more knowledge economy and the larger your firms are, the more of that mix, the less attendance we saw. You also had a separate set of drivers focused really on urban structure and so the extent to which you have long structural commutes and a large share of your folks commuting into cities on a daily basis and also linked up in urban structures, the share of homogenous office only neighborhoods that really anchor a city’s employment base. We found the subset of urban structures that were most disruptable were those with structural long commutes, homogenous neighborhoods.

Ryan Luby: Some of the most interesting findings in the report I think centered on the variation in post pandemic attendance that we’re observing and we saw sort of two different drivers of this variation in attendance. You had bread and butter macroeconomic dynamics, which we think about broadly as combination of sector and then firm size. So the more knowledge economy and the larger your firms are, the more of that mix, the less attendance we saw. You also had a separate set of drivers focused really on urban structure and so the extent to which you have long structural commutes and a large share of your folks commuting into cities on a daily basis and also linked up in urban structures, the share of homogenous office only neighborhoods that really anchor a city’s employment base. We found the subset of urban structures that were most disruptable were those with structural long commutes, homogenous neighborhoods.

These questions around a future-proofed office often focus on the magnetism of the individual floor or the individual building. I think there’s a really important point though about the magnetism of the broader neighborhood and the broader city. It starts with your commuter shed and the ease of access into the city. It moves closer to the neighborhood like amenities, the amount of retail, the amount of pull that you have. Are folks going into these urban cores to do something other than work? Are they going in there to live to play? Only then do you then say, okay, ‘what about this specific office? What about the floors, the engagement? What about that is magnetic?’ It’s really explicitly an ecosystem dynamic and I think that’s some of the most interesting and impactful findings in the report really focused on those dynamics.

Phil Kirschner: When being asked sort of like, why aren’t people coming here? It’s even forced me to be like, but why? But are people really coming here outside of your building? Right? You are subservient to this broader placemaking challenge depending on where you are.

Economics & Culture (14:10)

Ryan Luby: We see the adoption of hybrid at scale and scope as both a fundamental economic and cultural shift. So when we think about the winners and losers, which differentiates coming out in the post pandemic hybrid context, there is going to be a strong cultural component here. We focus really on flight to quality in terms of trophy offices, but you could just as easily frame that as a flight to quality in terms of trophy or vibrant city ecosystems with diverse neighborhoods, magnetic mixed use across a variety of activities. And so yes, there are core bread and butter economic implications, but what’s going to drive winning and losing dynamics here are also quite core cultural components.

Ryan Luby: We see the adoption of hybrid at scale and scope as both a fundamental economic and cultural shift. So when we think about the winners and losers, which differentiates coming out in the post pandemic hybrid context, there is going to be a strong cultural component here. We focus really on flight to quality in terms of trophy offices, but you could just as easily frame that as a flight to quality in terms of trophy or vibrant city ecosystems with diverse neighborhoods, magnetic mixed use across a variety of activities. And so yes, there are core bread and butter economic implications, but what’s going to drive winning and losing dynamics here are also quite core cultural components.

Technology’s Impact (15:07)

Phil Kirschner: Covid has forced the deployment of more collaborative, more asynchronous, more video-oriented applications than people were maybe accustomed to using in the past and an incredible amount of innovation, even patent energy and tools to support remote and distributed work. Then there’s the technology that affect the built environment, so meeting room booking and guest registration and all of that is not new, certainly as a hallmark of more modern offices even starting 15 years ago. But again, pushed forward is a lot of companies saying, well, we’re coming back. We need, if we’re sharing more, if we’re more sensitive to health, we have new entry requirements. Those have been pushed in, so becoming a little bit more systemic and the advances to those will start to come from things like gen AI. I don’t want to have to book. I want to eventually have my little co-pilot, like help me find a space that works for me.

Phil Kirschner: Covid has forced the deployment of more collaborative, more asynchronous, more video-oriented applications than people were maybe accustomed to using in the past and an incredible amount of innovation, even patent energy and tools to support remote and distributed work. Then there’s the technology that affect the built environment, so meeting room booking and guest registration and all of that is not new, certainly as a hallmark of more modern offices even starting 15 years ago. But again, pushed forward is a lot of companies saying, well, we’re coming back. We need, if we’re sharing more, if we’re more sensitive to health, we have new entry requirements. Those have been pushed in, so becoming a little bit more systemic and the advances to those will start to come from things like gen AI. I don’t want to have to book. I want to eventually have my little co-pilot, like help me find a space that works for me.

I need algorithmic and predictive help to keep things balanced better in our office. Then you get the kind of building stack technologies, more of the tenant experience, and that too is creeping up just a little bit before pandemic, but owners, operators, landlords are really confronted now the fact that we are consumers walking into these, especially multi-tenant buildings, and so kind of workplace apps like at the building level, showing us how to interact with the building, not just our private space, how to maybe book shared utilities, how to register guests and deal with security and order things, right. All that has become much more popular and then that leads into digital twin and augmented reality layer underneath everything we’re in, right? There’s such an incredible amount of data inherent to the built environment from energy use like room bookings who’s where we need help exposing that, not just to get help as an occupant to make facilities and predictive maintenance better to allow us to know things about the building and the built environment at the city level around us.

So I think that’s where we’re going to start seeing a lot more innovation and cities needing to participate with the major landlords, owners, operators, and municipal spaces on the digital layer that we can’t see, but that our mobile devices will help unlock.

The Rationale of Place (17:43)

Phil Kirschner: All this is leading to a reframing on the role of place and kind of the built environment in real estate is a competitive advantage. We need to get to a world where going to work or going to a workplace or to be with someone for the worker feels like a very conscious and easy choice instead of the challenge that it is now; there’s this enormous cognitive load of ‘Do I, don’t I? Where do I go? How do I find who is where?’ and for managers and leaders who now are acting very much on instinct of what they think works to get them to using real insights and measuring by outcomes, again, how is the work performing and not the inputs, like how many days are we here? Workers who are very well established in a hybrid modality spending at least half their time somewhere that’s not the office, are very hard to convince why they should be there. And we’re starting to see in our research that there are really force multiplying effects on organizational health for employees that agree with the reason why they’re asked to be somewhere. So that puts a huge amount of pressure on proving it to them why they should instead of just telling them that they should.

Phil Kirschner: All this is leading to a reframing on the role of place and kind of the built environment in real estate is a competitive advantage. We need to get to a world where going to work or going to a workplace or to be with someone for the worker feels like a very conscious and easy choice instead of the challenge that it is now; there’s this enormous cognitive load of ‘Do I, don’t I? Where do I go? How do I find who is where?’ and for managers and leaders who now are acting very much on instinct of what they think works to get them to using real insights and measuring by outcomes, again, how is the work performing and not the inputs, like how many days are we here? Workers who are very well established in a hybrid modality spending at least half their time somewhere that’s not the office, are very hard to convince why they should be there. And we’re starting to see in our research that there are really force multiplying effects on organizational health for employees that agree with the reason why they’re asked to be somewhere. So that puts a huge amount of pressure on proving it to them why they should instead of just telling them that they should.

A Different Value Construct (18:59)

Phil Kirschner: In my view, there are sort of four primary archetypes for how companies are consuming workspace for themselves: the we want you here most of the time where that’s like I have to build bigger, better, more intelligent, more activated, more experiential, the bar’s very high if you want to have a work culture that has most people in most of the time. Then there’s the real hybrid set, structured hybrid. They’re reorienting redesigning offices to be more collaborative, have people around little M most of the time, not big M most of the time, more sharing, but are rethinking how they’re designing spaces. The most interesting one to me are the companies that are truly taking a remote or virtual or digital first stance, complete employee autonomy about what they do. You may come in whenever or never, but they continue to build and those companies often rebrand those physical spaces. They are no longer offices, they are experience studios, they are collaboration centers, clients that – they’re anything but an office and they tend to be the ones looking at new and interesting ways of evaluating the kind of business case for those spaces. It’s not just utilization. Are there humans here but they’re more likely to think about the mobility profiles of their employees? How many people show up once a week, once a month, once a quarter? How many people are traveling to get here versus can commute to get here?

Phil Kirschner: In my view, there are sort of four primary archetypes for how companies are consuming workspace for themselves: the we want you here most of the time where that’s like I have to build bigger, better, more intelligent, more activated, more experiential, the bar’s very high if you want to have a work culture that has most people in most of the time. Then there’s the real hybrid set, structured hybrid. They’re reorienting redesigning offices to be more collaborative, have people around little M most of the time, not big M most of the time, more sharing, but are rethinking how they’re designing spaces. The most interesting one to me are the companies that are truly taking a remote or virtual or digital first stance, complete employee autonomy about what they do. You may come in whenever or never, but they continue to build and those companies often rebrand those physical spaces. They are no longer offices, they are experience studios, they are collaboration centers, clients that – they’re anything but an office and they tend to be the ones looking at new and interesting ways of evaluating the kind of business case for those spaces. It’s not just utilization. Are there humans here but they’re more likely to think about the mobility profiles of their employees? How many people show up once a week, once a month, once a quarter? How many people are traveling to get here versus can commute to get here?

One of my favorite new metrics that I’ve heard from Atlassian specifically, is cost per visit, which means you’re thinking about the value of the office as it compares to a business center; any other kind of space that you would have to literally pay to use, and there’s no right answer for that yet. There’s no benchmark, but companies that are more intentional about the purpose of these places can really think about are those places achieving those purposes? Instead of thinking about how many days are people here, what percentage walked in the door? So it’s a different value construct altogether.