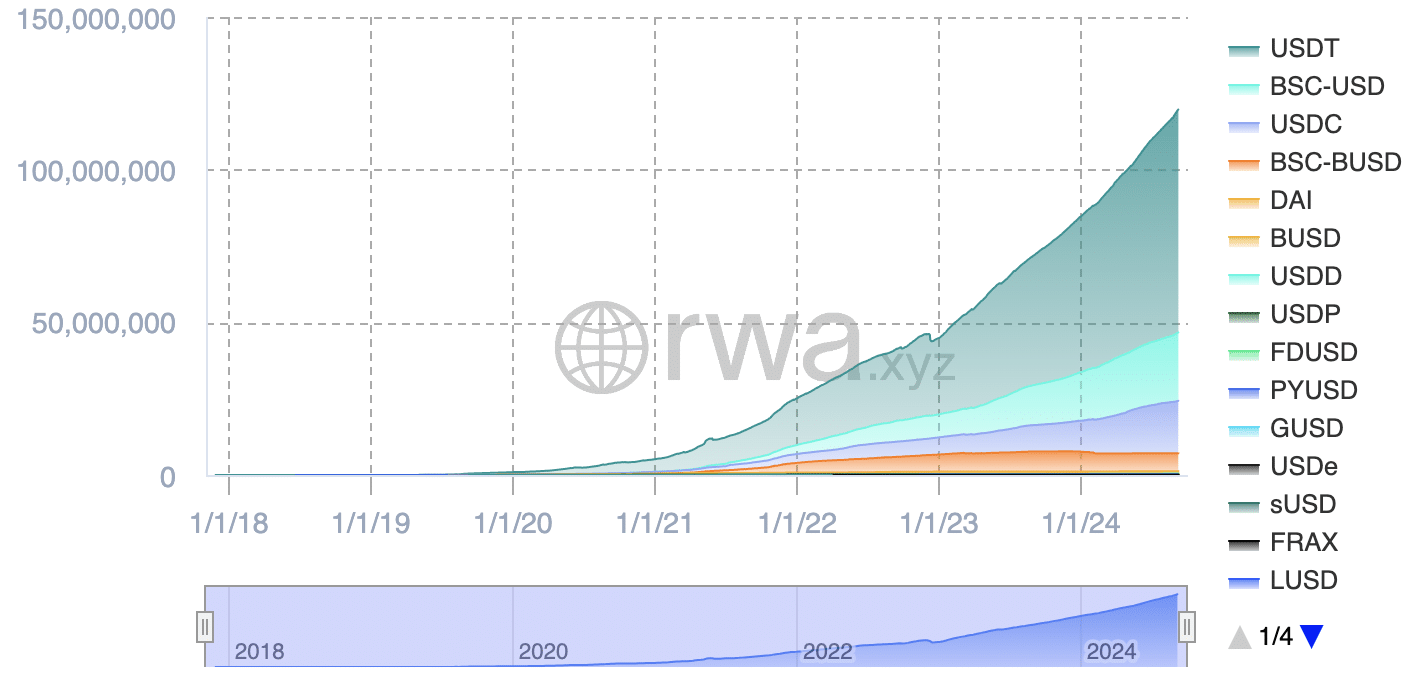

Stablecoins have seen explosive growth in the last four years, increasing from a $17.6 billion market capitalization to $170.6 billion. The number of holders has also skyrocketed from 3.78 million to 119.72 million. However, this growth brings critical questions. How safe is it to hold stablecoins? How secure are the assets backing stablecoins? Could stablecoins pose a threat to traditional banking systems, and how might governments react to such competition?

These are essential questions, yet they are often ignored. The TerraUSD (UST) collapse serves as a prime example, where only a small group of investors and analysts predicted its downfall before it finally happened. Many users simply trusted the system without questioning the true stability of the underlying assets. And, unfortunately, because of that blind trust, they lost a lot of money. Understanding the risks requires first exploring the broader concept of what money represents.

What is money?

Money = value. When a person buys a chocolate bar, they exchange money for that value. The merchant can then use the money to obtain the value they need in return.

Money hasn’t always existed in the form of paper bills or digital currencies. In ancient times, people used cattle, leather, mollusks, wheat, and salt as mediums of exchange. Eventually, societies shifted to gold as a more standardized form of value. But imagine going to the store and buying a chocolate bar for the price of 0.0353 ounces (1 gram) of gold. This would require scales, cutting tools, and is simply not convenient.

So, the government created a model that worked this way: The government takes your gold in exchange it gives you money depending on the exchange rate. It was the Gold Standard, which happened first in England in 1816. In time, the government changed the model now they were printing money without anything backing it, which is where we are now.

The trust model

The evolution from tangible value to paper money introduced a key factor: trust. Initially, people trusted the inherent value of a commodity like gold. Today, trust has shifted from something (gold) to someone (the government or central authority). Trust forms the basis of modern currency systems. Without trust, exchange would be impossible. For instance, no one would sell a house for a bag of rocks because rocks hold no universal trust or value.

Modern money, whether paper or digital, holds value only because of collective trust in the government or the central institution behind it. Without this trust, money would revert to being worthless pieces of cotton and linen.

What is fiat money?

The term “fiat” refers to a decree or order issued by someone in authority. When it comes to fiat money, its value stems not from any intrinsic property or commodity backing but from the government’s declaration that it holds value. In simple terms, money has value because the government says so.

Cons of fiat money

Fiat money has several critical weaknesses. It is centralized, meaning that trust is placed in the actions and integrity of banks and governments.

Another problem with fiat money is excessive printing, which leads to inflation.

So, several problems plague traditional money systems. First, paper currency can become worthless overnight due to governmental decisions. Second, the stability of money varies widely between countries. Inflation affects all currencies, but some experience it more severely, leading to rapid devaluation and loss of purchasing power.

But digital fiat money introduces its own set of issues. Banks operate on a fractional reserve system, meaning they hold only a portion of customer deposits in reserve. Laws and regulations, such as the Basel Accords and national banking laws, permit banks to lend out the majority of deposited funds. This practice transforms money into mere numbers on a ledger, essentially IOUs, without full backing.

The fractional reserve system also brings the risk of a bank run, where a large number of customers withdraw their funds at once due to fears about the bank’s solvency. Since banks do not hold all deposits in reserve, they often cannot meet the sudden demand for cash, which leads to panic and potential bank failure.

Stablecoins operate on a different level from traditional fiat money but are not entirely immune to these issues either. Unlike fiat currencies, stablecoins like USDT, USDC, and DAI aim to maintain a stable value by being pegged to a fiat currency, usually the U.S. dollar.

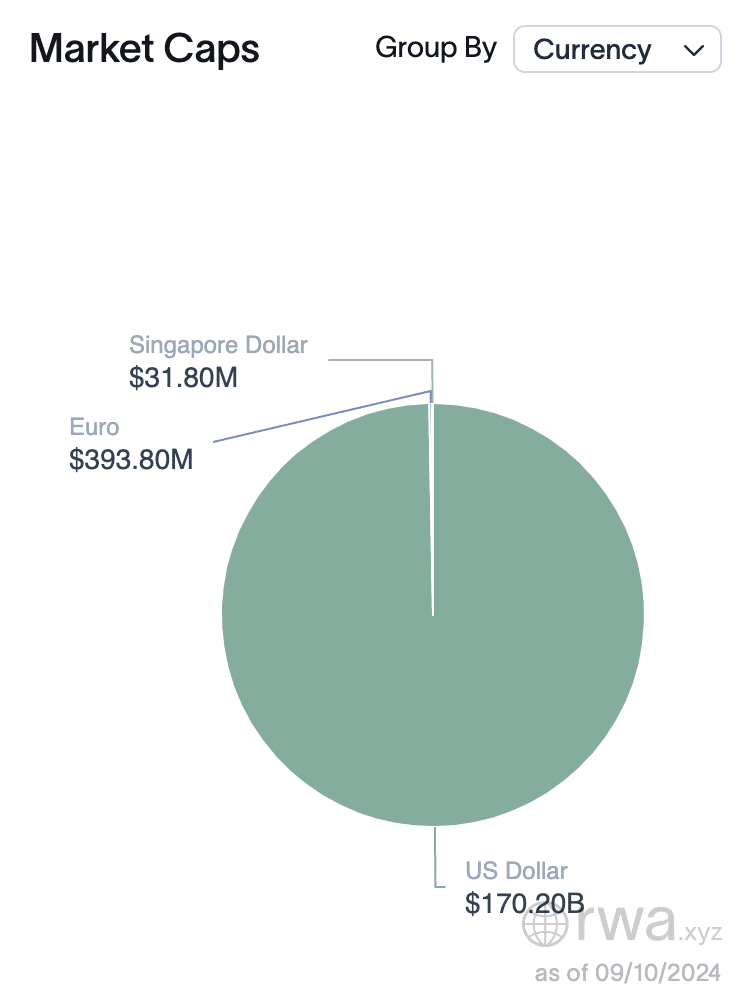

Why are the majority of stablecoins pegged to USD?

Before understanding how stablecoins differ from traditional fiat money, we need to explore why the U.S. dollar holds such a dominant position. Why not the Swiss Franc or the Japanese Yen? Many would respond that the dollar is simply used everywhere, but the real question is why it became the world’s dominant currency in the first place.

The U.S. dollar’s dominance is due to its “exorbitant privilege.” As long as the dollar remains the world’s reserve currency, the United States avoids balance of payment crises. Through mechanisms like the Petrodollar system and the forced purchase of the U.S. Treasuries by foreign central banks, the U.S. could borrow cheaply and spend without immediate consequence.

The system allows the U.S. to print dollars and use them to buy real goods and services globally, exporting the inflation created to other countries. This is one reason developing nations often suffer from higher inflation—they absorb the inflationary effects of American monetary policy. In essence, the U.S. has a unique advantage in the global economy, trading printed money for tangible goods without immediately facing inflationary pressures domestically.

The Federal Reserve lowers interest rates or engages in quantitative easing to inject new dollars into the economy. Such actions increase the total supply of dollars circulating globally. U.S. governments, corporations, and banks benefit from the system by accessing cheaper credit, which leads to the creation of more dollars as loans are issued. Newly minted dollars are used to import goods from abroad, further pushing dollars into foreign economies.

Once foreign countries accumulate dollars, they face a critical choice. They can allow their own currency to appreciate against the dollar, but doing so would harm their export competitiveness. Alternatively, they can print more of their own currency to maintain its value relative to the dollar. However, this approach often leads to domestic inflation, creating a cycle in which foreign central banks must balance the value of their currency against the effects of inflation.

The U.S. benefits enormously from the global arrangement. When foreign countries accumulate dollars, they frequently invest them in U.S. Treasuries, which effectively lend money to government at low interest rates. The process helps the U.S. finance its deficit spending on war, infrastructure, and social programs. The U.S. can sustain such expenditures because foreign nations continue to buy its debt, driven by their need to hold dollars for trade and financial stability.

This is why the vast majority of stablecoins are pegged to the U.S. dollar, and almost the entire stablecoin market revolves around it as the anchor.

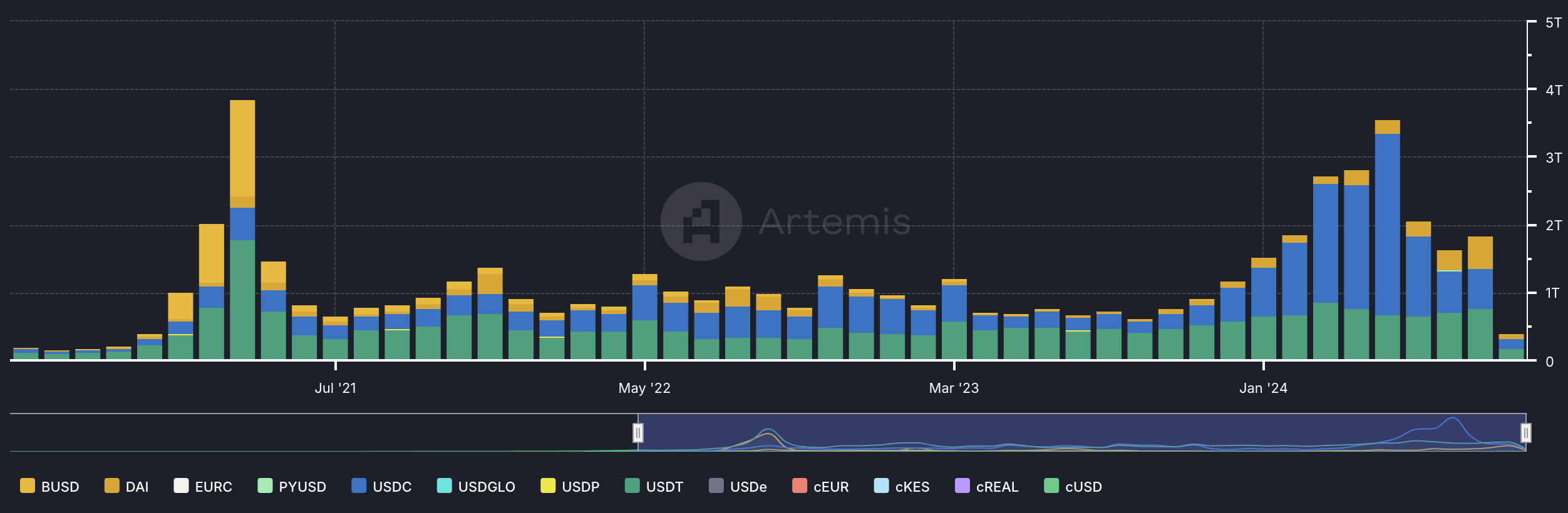

In just four years, the monthly transfer volume of stablecoins has increased from $202 billion to $3.6 trillion.

To put that into perspective, when compared with traditional finance, the U.S. dollar forex trade in 2022 reached $2,739 trillion, according to the Progressive Policy Institute. By 2024, it is reasonable to estimate that trade will grow to $3 trillion, translating to approximately $250 trillion traded per month. So, stablecoins already represent nearly 1.5% of the dollar trade.

How do stablecoins maintain their peg?

The vast majority of stablecoin market volume and capitalization is concentrated in three primary coins: USDT, USDC, and DAI. Each of these stablecoins employs different mechanisms to maintain their peg to the U.S. dollar.

USDT

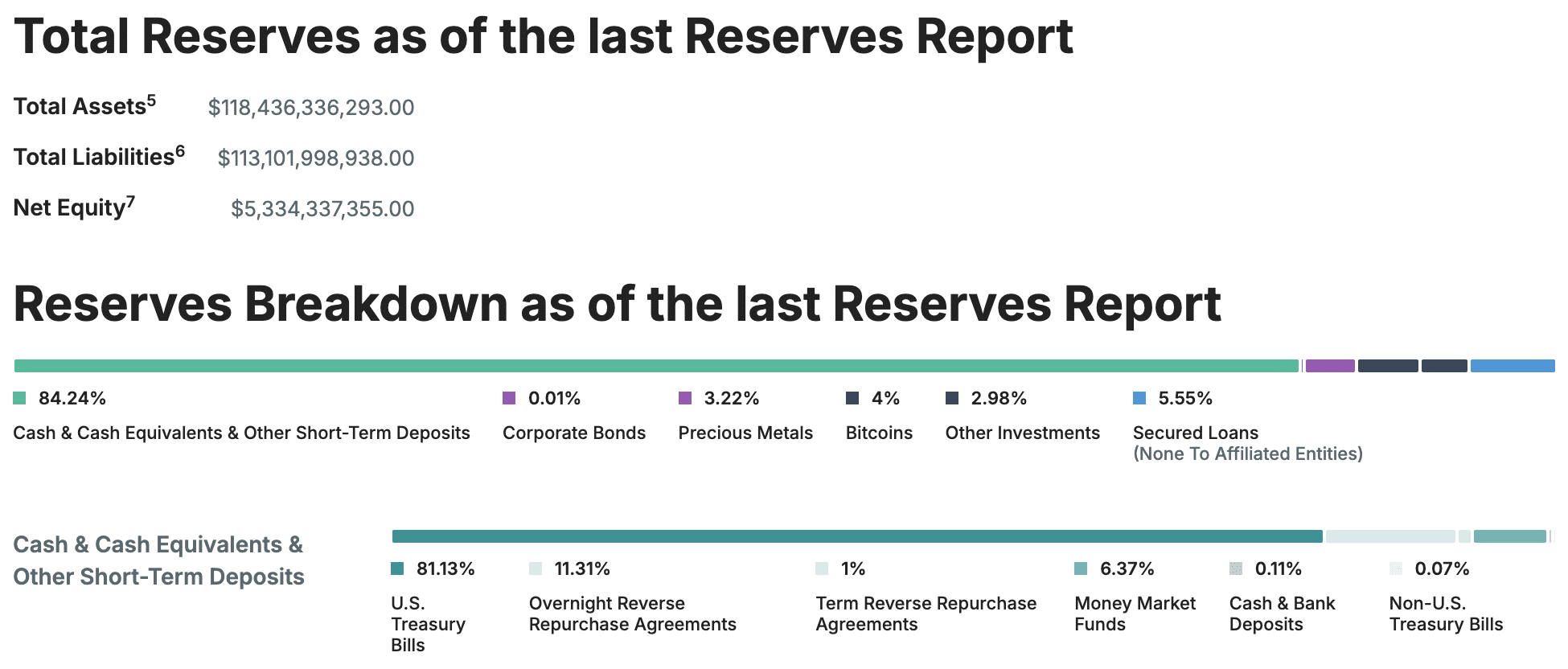

Tether (USDT) keeps its peg to the U.S. dollar through a system of reserve assets and strict issuance protocols. For every USDT token in circulation, an equal amount of value exists in reserve, typically held in cash, cash equivalents, and U.S. Treasuries. The reserves ensure that each USDT can be exchanged for one USD.

When demand for USDT grows, Tether issues additional tokens, matching them with the necessary reserve assets. In contrast, when users exchange USDT for USD, the tokens are destroyed to keep the supply in line with the reserves.

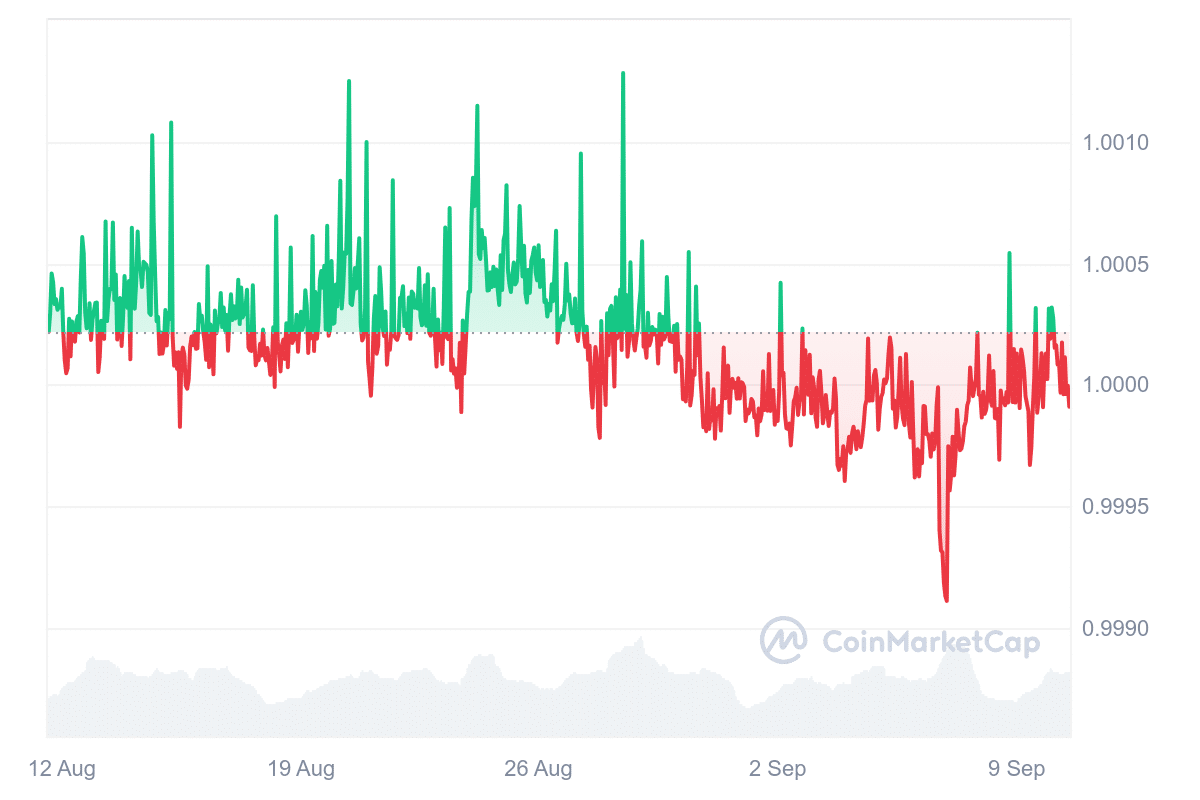

The peg always deviates slightly due to liquidity imbalances or shifts in supply and demand on exchanges.

For instance, during periods of heightened market activity or stress, a sudden surge in demand for USDT could cause the price to rise above $1, as traders may pay a premium for quick access to a stable asset. Conversely, a rapid sell-off of USDT can lead to a brief dip below $1, as the supply temporarily exceeds demand.

Only entities that are verified and have an account with Tether can directly exchange USDT for USD. Typically, these entities are institutional clients, large traders, or exchanges. On the other hand, retail investors or smaller traders cannot redeem USDT directly from Tether. Instead, they usually convert USDT to USD on cryptocurrency exchanges.

However, controversy has surrounded Tether for years, and negative sentiment remains strong. One of the primary concerns revolves around the transparency of Tether’s reserves. Critics have questioned whether Tether has always maintained a full 1:1 backing for USDT tokens. In 2021, Tether settled with the New York Attorney General’s office after an investigation found that Tether had misrepresented the extent of its reserves in the past.

Another point of criticism is the lack of full audits by top-tier accounting firms. While Tether has started providing transparency reports on a quarterly basis, many are skeptical due to the absence of comprehensive audits by major global accounting firms.

Despite the controversies and skepticism, Tether remains extremely profitable due to its widespread use. In the first half of 2024 alone, Tether reported a profit of $5.2 billion.

USDC

USDC operates in much the same way as USDT. However, the key difference lies in USDC’s emphasis on regulatory compliance and transparency. (USDC) Coin conducts monthly audits through top-tier accounting firms to verify its reserves to ensure users that each USDC token is backed 1:1 by real assets. The audit process provides a higher level of confidence compared to Tether’s quarterly attestations, as it aligns more closely with regulatory standards in traditional finance.

Despite their differences in transparency and regulatory alignment, both USDT and USDC share one major characteristic: centralization. The issuers can freeze or block tokens in specific accounts in compliance with legal orders. Both stablecoins have a history of blocking addresses when required by law enforcement or government authorities, which adds a layer of control that conflicts with the decentralized ethos of crypto.

DAI

But unlike USDT and USDC, DAI is a decentralized, overcollateralized stablecoin. DAI (DAI) is not issued by a centralized entity but is instead generated by users who lock up cryptocurrency (such as Ethereum) as collateral. The system requires that the value of the collateral exceed the value of the DAI generated. So even if the collateral’s value fluctuates, DAI remains adequately backed. If the value of the collateral drops too much, it is automatically liquidated to maintain the peg. One of the major advantages of DAI is that it cannot freeze, block, or blacklist specific addresses.

The future of stablecoins and government action

At present, stablecoins already represent around 1.5% of the global U.S. dollar trade, but the real tipping point will come when that figure reaches a much higher level — somewhere between 5% and 15%. Once stablecoins capture that much of the market, governments will likely need to work in tandem with the issuers, creating a regulated environment that merges traditional finance with the growing crypto ecosystem. Governments could either embrace stablecoins as a way to enhance the global dominance of the U.S. dollar or respond with strict regulatory oversight.

While some may suggest that governments might try to make stablecoins illegal, that scenario seems unlikely. Stablecoins, especially those pegged to the U.S. dollar, further cement the global power of the U.S. currency, aligning with national interests rather than working against them. By maintaining the status of the USD in global transactions through stablecoins, governments are likely to see their value in reinforcing the American dollar’s position worldwide.

But the rise of stablecoins also raises questions about security and reliability. Holding traditional paper money presents its own risks, including inflation and devaluation. Digital money in banks is also vulnerable, as seen with events like bank runs or systemic failures. And stablecoins carry big risks as well.

The collapse of TerraUSD, despite its entirely different structure from assets like USDT, USDC, and DAI; the situation with Silicon Valley Bank and USDC’s brief de-pegging in 2023, along with long-standing controversies surrounding USDT’s transparency, has shown that stablecoins are far from immune to market shocks and liquidity issues. While they offer some advantages, they are not entirely reliable for long-term wealth storage.

So, what should one hold? Following the TerraUSD collapse, it became clear that holding too much in any one stablecoin can be risky. A more balanced approach might involve holding assets that appreciate in value, such as stocks, bonds, BTC, ETH, SOL, or real estate while maintaining a small portion of cash or stablecoins for liquidity purposes. Ideally, this reserve should be enough to cover between 3 to 24 months of expenses, depending on one’s risk tolerance, and it could be kept in a high-yield savings account or through well-established decentralized finance platforms.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.